Comptroller and Auditor General of India

Comptroller and Auditor General of India (CAG)

The Comptroller and Auditor General of India (CAG) is a key constitutional authority responsible for auditing the accounts of the central and state governments. Established under Article 148 of the Constitution, the CAG plays a crucial role in ensuring transparency and accountability in the financial administration of the government.

Appointment and Term

- Appointment: The CAG is appointed by the President of India through a warrant under his hand and seal.

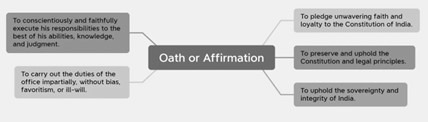

- Oath of Office: Before assuming office, the CAG takes an oath to uphold the Constitution, the sovereignty of India, and to perform duties without fear or favor.

- Tenure: The CAG holds office for a period of six years or until the age of 65 years, whichever is earlier. The CAG can resign at any time by addressing the resignation letter to the President.

- Removal: The CAG can be removed in the same manner as a Supreme Court judge—by the President, following a motion passed by both Houses of Parliament with a special majority for reasons of misbehavior or incapacity.

Independence

To maintain the CAG’s independence and integrity:

1. Security of Tenure: The CAG cannot be removed except through a process laid out in the Constitution.

2. Post-Office Security: The CAG is not eligible for any other government office after holding the position.

3. Salary and Conditions: The salary and conditions of service are determined by Parliament and are equivalent to that of a Supreme Court judge.

4. Non-Discretionary Pay: The CAG’s salary and rights regarding leave, pension, and retirement cannot be altered to his disadvantage after appointment.

5. Administrative Expenses: The office’s administrative expenses are charged to the Consolidated Fund of India, ensuring they are not subject to parliamentary voting.

6. No Ministerial Representation: No minister can represent the CAG in Parliament, nor can they be held accountable for actions taken by the CAG.

Duties and Powers

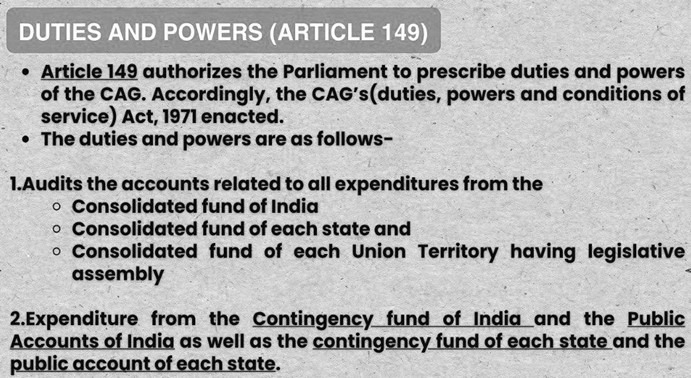

The Constitution grants the CAG a range of duties and powers, primarily detailed in Article 149 and further defined through the CAG’s (Duties, Powers and Conditions of Service) Act, 1971. The key functions include:

1. Audit of Government Accounts:

- Auditing all expenditures from the Consolidated Fund of India, as well as from the Consolidated Fund of each state and union territory with a legislative assembly.

- Auditing the Contingency Fund of Indiaand public accounts of the states.

2. Financial Monitoring:

- Checking that the assessment, collection, and allocation of revenues adhere to set rules and procedures.

3. Audit of Public Bodies:

- Auditing the accounts of government companies and other authorities funded by the state or central revenues.

4. Verification of Tax Proceeds:

- Ascertaining and certifying the net proceeds of taxes or duties as defined under Article 279, with the results being final.

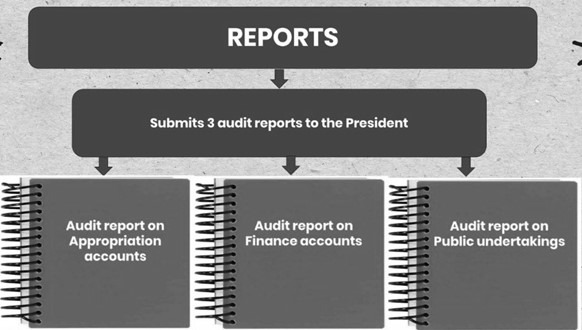

5. Reporting:

- Submitting audit reports to the President regarding the accounts of the Union and the states, which must then be laid before the Parliament and the state legislature, respectively.

6. Advisory Role:

- Acting as a guide for the Public Accounts Committeeof Parliament.

7. Administration of Accounts:

- Maintaining the accounts of state governments. Previously, this included the accounts of the Central Government, which were separated following the departmentalization of accounts in 1976.

8. Additional Reports:

- The CAG submits three key audit reports to the President: the audit report on appropriation accounts, the audit report on finance accounts, and the audit report on public undertakings.

Role of the CAG

1. Guardian of Public Purse:

- The CAG acts as the guardian of the public purse and is responsible for monitoring the financial administration of both central and state governments.

2. Accountability Mechanism:

- The CAG ensures accountability of the executive (the council of ministers) to Parliament through audit reports, serving as an agent of Parliament.

3. Auditing Powers:

- The CAG has broad powers relating to the audit of expenditure but has more constraints regarding the audit of receipts, stores, and stock.

- While examining expenditure, the CAG can define the scope of the audit and develop its audit codes and manuals, whereas, for receipts, it requires approval from the executive government.

4. Legal and Propriety Audit:

- The CAG conducts both legal and regulatory audits and can perform propriety audits, evaluating the wisdom, faithfulness, and economy of government expenditures. Propriety audit is not obligatory but is exercised at the CAG’s discretion.

5. Restrictions on Audit:

- Certain expenditures, particularly those related to secret services, limit the auditing authority of the CAG. It cannot request particulars of these expenditures but must accept certificates from the relevant administrative authorities confirming that expenditures were authorized.

6. Comparison with British CAG:

- Unlike the CAG in Britain, who has control over the issuance of funds, the CAG in India only audits expenditure after it has occurred, lacking direct authority over financial disbursements.

Relationship with Public Corporations

The CAG’s role in auditing public corporations varies:

1. Direct Audits:

- Some corporations, such as the Damodar Valley Corporationand Oil and Natural Gas Commission, are audited directly by the CAG.

2. Private Auditors:

- Other corporations may be audited by private professional auditors appointed by the Central Government, with the CAG conducting supplementary audits as needed. An example includes the Central Warehousing Corporation.

3. Exclusive Private Audits:

- Certain corporations, such as the Life Insurance Corporation of India, undergo audits exclusively by private auditors, submitting their reports directly to Parliament without CAG involvement.

Audit Board

To enhance the technical aspects of audits, an Audit Board was established in 1968 within the CAG’s office on the recommendations of the Administrative Reforms Commission. This board, consisting of a Chairman and two members, was created to involve external specialists in auditing specialized enterprises, such as those in engineering and chemicals.

Criticism by Paul H. Appleby

Paul H. Appleby criticized the role of the CAG in his reports on Indian administration, providing several points:

1. Colonial Legacy: He argued that the CAG’s functions largely stem from colonial practices.

2. Repressive Influence: He claimed that the CAG contributes to a lack of decisiveness in governmental actions, viewing auditing as a negative influence.

3. Misunderstood Importance: He suggested that Parliament overestimates the significance of auditing in terms of parliamentary responsibility.

4. Limited Expertise: Appleby posited that auditors do not have sufficient knowledge about effective administration; therefore, their insights on governance are limited.

5. Narrow Perspective: He characterized auditing as a pedestrian function with restricted utility, emphasizing that department officials typically know their issues better than auditors.

Articles Related to the Comptroller and Auditor General of India

Article No. | Subject-matter |

148 | Comptroller and Auditor-General of India |

149 | Duties and powers of the Comptroller and Auditor-General |

150 | Form of accounts of the Union and of the States |

151 | Audit reports |

The Comptroller and Auditor General of India serves as an essential pillar of fiscal accountability in the Indian government. By providing independent audits, the CAG ensures that public funds are used efficiently and for their intended purposes. The critical functions of the CAG, along with its constitutional safeguards for independence, contribute significantly to promoting transparency and strengthening democratic governance in the country.